By now, we’re all pretty familiar with the Families First Coronavirus Response Act (FFCRA). The FFCRA requires employers to provide paid sick leave and paid family and medical leave for their employees under certain conditions related to COVID-19. The act also credits wages and the employer’s portion of the Medicare tax against the employer’s federal tax liability.

Top Tip: You can learn more about the FFCRA and how it applies to your business here.

Further, the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) gives employers the option to defer or postpone the employer’s paid portion of Social Security taxes. Through the CARES Act Social Security tax deferral, employers must repay 50% of the deferred amount by 12/31/2021. They will need to repay the remaining 50% by 12/31/2022.

The impact of these two laws is that certain amounts are deducted from your federal tax liabilities and payments. Here’s how you can expect the legislation to affect this quarter’s Form 941.

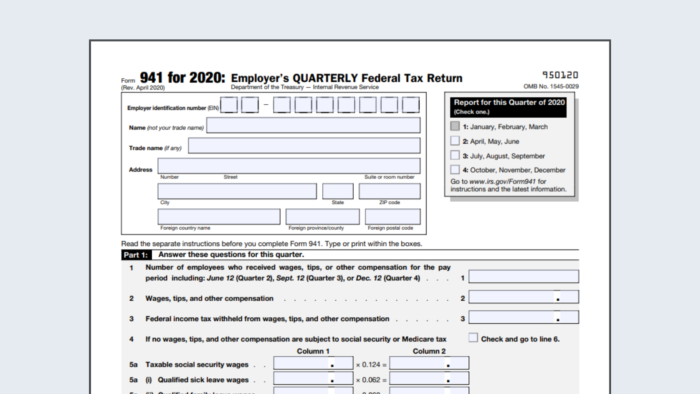

Changes to Form 941

To properly report these amounts, the Internal Revenue Service made significant changes to the Form 941, Employer’s Quarterly Federal Tax Return. You can find the revised form here.

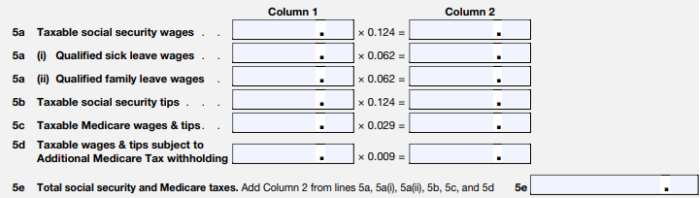

In addition to Social Security tax deferral, employers will also report FFCRA tax credits on the revised form. The credits are shown by reporting FFCRA wages on line 5a(i) for sick leave and 5a(ii) for family leave. However, you will notice that the rate of these two lines is half of the Social Security tax amounts. This is because those wages are not taxable for the employer’s portion.

Next, employers can report their employees’ FFCRA wages on Line 11b.

![]()

Finally, Line 13b of the revised form reports the deferred amount of the employer’s portion of Social Security taxes under the Cares Act.

![]()

FAQ

1. If I don’t have Social Security tax deferrals or FFCRA credits, how will this impact me?

Answer: These fields will have zeros in them, but the form may look different to you because the layout has changed.

2. Does the deferral include an extension of time to file the employment tax returns?

Answer: No, the employment tax returns are still due on July 31st for the second quarter.

3. Will SDP be filing the return for me?

Answer: Yes, if you have Southland Data Processing’s full tax service, then we will complete and file the returns for you.

4. How often are the 941 forms filed?

Future Updates

For more business tips and news, be sure to check out SDP’s blog at www.sdppayroll.com/blog. Here, we post weekly content to keep you compliant and informed. And don’t forget to follow us on Facebook, Twitter, and LinkedIn for even more HR and business updates!